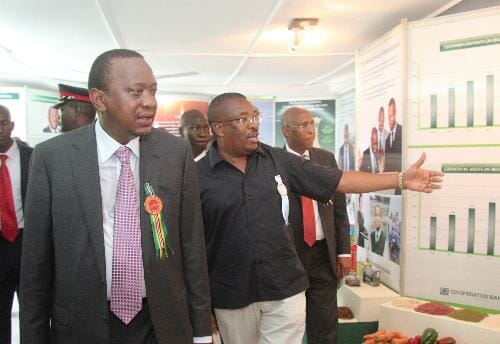

PICTURED: President Uhuru Kenyatta together with Cooperative Bank MD Gideon Muriuki.

The Ethics and Anti-Corruption Commission (EACC) Chairman Halakhe Waqo was paid off millions of shillings to ignore a letter detailing how Cooperative Bank’s Directors some who include Government officials, plus senior staff conspired to manipulate an IPO and defraud Kenyan farmers true value of their shareholding, whilst buying a stake in the farmer-owned bank.

If you will all remember an episode of “Who Owns Kenya” aired by Citizen TV, Julie Gichuru detailed that the highest shareholders of Cooperative Bank include the Chairman Stanley Muchiri and MD Gideon Muriuki, contrary to all laid down guidelines by Capital Markets Authority (CMA).

But because Cooperative bank is a big advertising spender, every editor and business journalist has been bribed to kill this story and we now take the bold step to expose Cooperative Bank and their underhand tactics to steal from poor farmers.

As we in look back on where the country lost direction, we will remember that journalists in Kenya have been the biggest impediment and are accessories to the crimes committed. They are the fourth arm of Government and fuctionaries of the status-quo.

To news sources out there, don’t trust mainstream media, dont trust Jubilee operatives like Ory Okolloh, Robert Alai and Boniface Mwangi. Send us all details that media have refused to run and we will air without fear of favour.

Mr. Halakhe D. Waqo

Chief Executive Officer and Commission Secretary

Ethics and Anti-Corruption Commission

C/o EACC, Report Center

Ground Floor, Integrity center,

Valley Road / Milimani Road Junction.

P.O. Box 61130 00200

Nairobi,

Kenya

18 December 2015

RE: COOPERATIVE BANK OF KENYA INSIDER DEALING SCHEME.

REQUEST FOR AN INVESTIGATION IN THE MATTER OF A CONSPIRACY BETWEEN THE BOARD OF DIRECTORS AND SENIOR STAFF TO FRAUDULENTLY ACQUIRE SHARES AND CONTROL OVER THE COOPERATIVE BANK OF KENYA

Dear Sir,

KESCOGA is registered coffee farmers’ organisation. We commend your Commission and the good work it is doing to bring an end to corruption and economic crimes in Kenya. We also seek to contribute to your efforts by supplying your Commission with information that will assist the Commission to deliver its objectives. It is in this regard that we forward to you this matter of fraudulent insider dealing at the Cooperative Bank of which has never been investigated despite the obvious illegality and criminality involved. We hope you will pick this issue up for the benefit of Kenyan coffee farmers who as shareholders are being swindled by their employees.

- Background

The Co-operative Bank of Kenya Limited was registered in 1965, as a Co-operative Society, 100% privately owned by ordinary poor Kenyans through their Co-operative Societies. Owing to the Bank’s rapid expansion and the strain in raising additional share capital from the co-operative societies to support the expansion, the Bank’s by-laws were amended in 1996 to allow individual members of registered co-operative societies to buy its shares. As at 31 December 2006, Societies held 84% (i.e. 21,884,020 shares of Kshs.100 each), commonly referred to as Class A shares while over 51,000 individual members held 16% (i.e. 4,305,750 shares of Kshs.100 each), commonly referred to as Class B shares.

- Conspiracy between Bank Directors and senior staff to fraudulently acquire Bank shares

In April 2007, the Directors (who include two senior government representatives) conspired to acquire a huge chunk of the Bank’s shares at the par value, ahead of a planned IPO, in anticipation of making huge profit gains after the listing of Bank shares at the Nairobi Stock Exchange and consolidating their positions in the Board. In a speech delivered by the Chairman during the Bank’s AGM held in Karen on 28 April 2007 and attended by the Minister for Co-operatives and other senior government officials, the delegates were informed that the Bank intended to sell Class B shares to its senior managers in an effort to enhance staff retention.

The Chairman failed to disclose, to the AGM, the following material facts regarding the new shares; (a) the specific number of Class B shares that would be sold to the staff,

(b) That over 50% of the new Class B shares would be sold to the directors

(c) That the Bank also intended to sell Class A shares to co-operative societies and lastly,

(d) That there was an impending plan to convert the Bank from a society to a company and to list bank shares at the NSE in 2008. The AGM adopted the chairman’s speech thereby, presumably granting a blanket approval to the Bank to issue and sell an undisclosed number of class B shares to its senior staff.

THE FRAUDULENT INSIDER DEALING SCHEME AND BENEFICIARIES

Between 30 April 2007 and 30 June 2008, 2,522,376 new Class A & B shares of Kshs.100 each that would have fetched Kshs.2.4 billion at Kshs.9.50 each after the share split in the ratio of 1:100 in the Bank’s Initial Public Offer in December 2008, were irregularly sold to insiders i.e. Bank directors, senior staff and co-operative societies associated with the directors, all for a paltry Kshs.252 million. Immediately prior to the IPO of December 22, 2008, the Directors declared a share split of one: one hundred – effectively multiplying the number of shares they held one-hundred fold before going to the market and reducing the par value of the share to Kshs1.

In breach of Companies Act, the directors used their office to lend themselves Kshs. 84 million worth of soft loans to finance the purchase of the shares they allotted themselves. This also broke the Central Bank of Kenya rules and regulations regarding capital. Lending themselves shareholders money to buy shares at Kshs 1 each was abuse of office and the directors and senior management benefitted personally in the scheme to create a massive margin for secret profits as the IPO price was eventually Kshs.9.50 per share.

- a) Beneficiaries of the 2,522,376 Class A& B Shares

| No. | Beneficiaries | % | Shares (No.) | Par Value (Kshs) | IPO Value (Kshs) |

| 1 | Directors | 55% | 1,389,960 | 138,996,000 | 1,320,462,000 |

| 2 | Senior Staff | 44% | 1,109,650 | 110,965,000 | 1,054,167,500 |

| 3 | Co-op Societies | 1% | 22,766 | 2,276,600 | 21,627,700 |

| Total Shares | 100% | 2,522,376 | 252,237,600 | 2,396,257,200 |

The Directors fraudulently acquired 1,389,960 Class B shares of Kshs.100 each, (that would have fetched Kshs.1.32 billion at Kshs.9.50 each after the share split in the ratio of 1:100) in the Bank’s Initial Public Offer in December 2008 for a paltry Kshs.138million, causing a loss to the Bank and its then shareholders of more than Kshs.1.2 billion. The directors granted themselves, contrary to Central Bank of Kenya rules and regulations, loans totaling to Kshs.64million in 2007 and Kshs.20million in 2008 respectively, to facilitate the acquisition of the shares and to eventually make massive profits from this borrowed money. The table below demonstrates this.

- b) Director’s interest in ordinary share capital as at 31 December 2008 (post IPO)

| NO. | DIRECTOR | SHAREHOLDING | SHAREHOLDING | AMOUNT PAID | PROFIT GAIN |

| NAME | NO. | % | KSHS’ | KSHS’ | |

| 1 | Gideon Muriuki (MD) | 68,121,000 | 49% | 68,121,000 | 579,028,500 |

| 2 | Stanley Muchiri (Chairman) | 8,000,000 | 6% | 8,000,000 | 68,000,000 |

| 3 | Julius Riungu | 7,700,000 | 6% | 7,700,000 | 65,450,000 |

| 4 | Macloud Malonza | 5,110,000 | 4% | 5,110,000 | 43,435,000 |

| 5 | Rosemary Githaiga | 5,090,000 | 4% | 5,090,000 | 43,265,000 |

| 6 | Scholastica Odhiambo | 5,080,000 | 4% | 5,080,000 | 43,180,000 |

| 7 | Patrick Githendu | 5,073,700 | 4% | 5,073,700 | 43,126,450 |

| 8 | G. Mburia | 5,051,000 | 4% | 5,051,000 | 42,933,500 |

| 9 | Elijah K. Mbogo | 5,010,000 | 4% | 5,010,000 | 42,585,000 |

| 10 | Cyrus N. Kabira | 5,000,000 | 4% | 5,000,000 | 42,500,000 |

| 11 | Julius Sitienei | 5,000,000 | 4% | 5,000,000 | 42,500,000 |

| 12 | Dr. James Kahunyo | 5,000,000 | 4% | 5,000,000 | 42,500,000 |

| 13 | Fredrick Odhiambo (Commissioner of Cooperative Development) | 2,750,000 | 2% | 2,750,000 | 23,375,000 |

| 14 | Richard Kimanthi | 2,310,000 | 2% | 2,310,000 | 19,635,000 |

| 15 | Rtd. Major G.J.S. Wakasiaka | 2,300,000 | 2% | 2,300,000 | 19,550,000 |

| 16 | Wilfred Ongoro | 1,400,000 | 1% | 1,400,000 | 11,900,000 |

| 17 | John Murugu (Finance Ministry) | 1,000,000 | 1% | 1,000,000 | 8,500,000 |

| SUB-TOTAL | 138,995,700 | 100% | 138,995,700 | 1,181,463,450 |

Source: Bank’s Annual Report and Accounts for 2008 (Page 145)

At present, (2015), the Bank’s shares trade on the Nairobi Securities Exchange as high as Kshs 21. All the 139 million shares shares in the hands of the Directors were acquired at Kshs.1.00 each but would have fetched the bank Kshs.9.50 each had they been offered to the public during the IPO in 2008 or at a future date. The table above shows what the Directors gained in profit at the expense of the bank and the original shareholders – a profit of over 1 billion shillings. Other than the Bank chairman who invested Kshs.100,000, all other directors, the MD and senior staff did not invest in Bank shares during the IPO. Surely, this is a matter which the Ethics and Anti-Corruption Commission must investigate.

- c) The Managing Director acquired 681,121 Class B shares of Kshs.100 each, (that would have fetched Kshs.650 million at Kshs.9.50 each after the share split in the ratio of 1:100 in the Bank’s Initial Public Offer in December 2008) for a paltry Kshs.68 million, thereby causing the Bank a loss of Kshs.580 million. The MD thus ranked as the 2nd highest shareholder of the Bank allocated shares equivalent to 50% of all the 1,389,960 Class B shares illegally acquired by directors and just fewer than 2% of the entire shareholding in the Bank.

- d) The Senior Staff Members were offered 1,109,650 ordinary shares by the directors for Kshs.111 million with the sole aim of winning their support and co-operation in defrauding the bank, thereby making personal profit gains at the expense of the Bank of Kshs.943 million and participating fully in the dividend of Kshs.0.08 and Kshs.0.10 for every ordinary share declared in 2007 and 2008 respectively. Like the directors, senior staff was granted loans, contrary to Central Bank of Kenya rules and regulations, ranging between Kshs.1.5million and Kshs.5million to facilitate the acquisition of the said shares.

- e) Co-operative Societies linked to the directors, between 30 April, 2007 and 31 July 2008, fraudulently acquired 22,766 new Class A shares for a paltry Kshs.6 million, with the aim of gaining undue advantage over other individuals in the election of delegates and directors of the Bank held in August 2008 and making aprofit for their societies at the expense of the Bank of Kshs.210 million and participating fully in the dividend of Kshs.0.08 and Kshs.0.10 for every ordinary share declared in 2007 and 2008 respectively. All the directors survived the elections unopposed; thanks to the new shares and hefty handouts paid to the delegates .